Your One Stop Shop For All of Your Real Estate Needs!

Serving Jefferson County

Exceeding Your Expectations

As Your Realtor

Your home is prepared for sale. Even if you're eager to see "SOLD" displayed on the curb, you are aware that there are many things to think about beforehand. Selecting a real estate firm and agent to work with you in the process is one of your first choices. A yard sign, a box of fliers, and infrequent viewings are not enough for you. Your house deserves to be sold fast and for the greatest possible price, and you deserve a real estate expert who will work directly with you from beginning to end. In addition to buying homes, we also buy distressed and foreclosure properties and can guide you through the process.

Assuring the Best Exposure

As a result of our team's local real estate market experience, we are able to understand all data and determine the best pricing approach for your home. Because every market is unique, our marketing strategies and staging techniques successfully target and attract your potential customers. To pinpoint the particular selling points of your house and community, we conduct in-depth research. It is a recipe for achievement. Naturally, we also take the time to hear about and comprehend your issues and objectives. Any queries you may have along the route, we are pleased to address.

WE HELP YOU STAY

One Step Ahead

We are aware of how crucial it is to be informed when selling a property. And occasionally it entails taking matters into your own hands. In order to ensure that you have the proper individuals and procedures in place to sell your property quickly and at the best price, we're delighted to give you the resources you'll need to look for an agent and create a plan.

Communities

CHOOSE THE COMMUNITY WHERE YOU WANT TO LIVE

All About

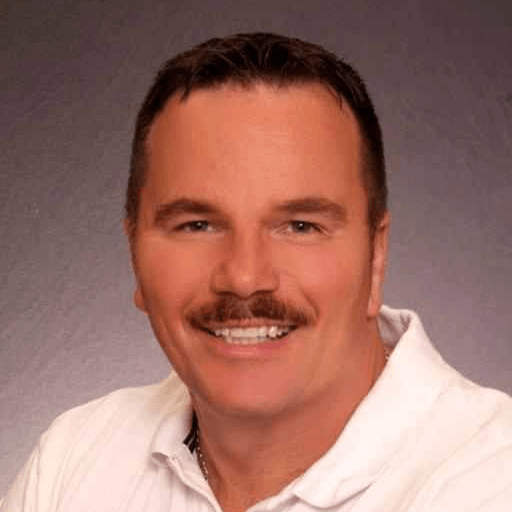

Jeff Druck, BROKER-OWNER

Jeff has over 20 years of experience in the Real Estate Industry. He started out with Semonin Realtors in 1990 and worked there for 5 years, after learning about real estate he joined Remax Associates in 1995 where he presently works. Jeff has lived in Louisville all his life and loves it. He knows all the neighborhoods inside and out and can help you select the best one for your family's needs. Jeff uses the latest technology to expose your property to the widest possible range of qualified buyers.

Why choose Jeff as your real estate agent? For one thing, he cares, he really listens and will work tirelessly on your behalf. People have referred to him as the real estate contract negotiator because of his great negotiating ability. His expertise covers all the different areas of real estate from selling your home to buying a home, property management and commercial transactions. Jeff has been a top producer since he started in real estate and has been involved in hundreds of transactions.

Our Mission Statement to You

To provide the highest level of professional service and to achieve the highest rates of client retention and customer satisfaction in the real estate industry. Stated more simply, to be the best and to never settle for less!

Core Values

- Demonstrate uncompromising integrity in all things at all times. No exceptions, ever. Our collective organizational reputation is our single most valuable asset.

- Our clients' interests supersede our interests.

- Practice the "Golden Rule" with respect to everyone at all times: our clients, other agents, other agents' clients and the general public.

- Always treat everyone the way you would want to be treated. Make your enemy your friend.

- Under-promise and over-deliver. Not some of the time. ALL of the time.

- Never be satisfied with mediocrity. Never stop improving, learning and growing. Know your weaknesses and work hard to overcome them.

- Demonstrate professionalism in all things at all times. Lead by example and strive to elevate those around you with your complete commitment to excellence.

- Focus on the client and the dollars will come; focus on the dollars and the client will not return.

- Attitude is everything. Positive thinking produces positive results. The long view is the ONLY view.

- Always base decisions on the long-term implications.

- YOU are the ultimate determinant of your level of success in this industry.

WE COMPLETELY AGREE WITH THE MISSION STATEMENT AND CORE VALUES. FURTHER, WE AGREE TO EMBRACE THESE PRINCIPLES AND TO ABIDE BY THEM IN ALL THAT WE DO AS REAL ESTATE PROFESSIONALS.

Learn about Our Property types

We Know How to Sell Your Home

YOur experts in

Distressed & Foreclosed Properties

Need to sell your home or distressed property? Cost, condition, or even location are no restrictions on our employees. We have a vast variety of resources at our disposal and maintain tight relationships with several progressive real estate agents and investors around the country. You consider your home to have minimal equity, making a sale impossible. Price is just one of several factors that help someone sell quickly. Once our team has a thorough grasp of your problem, they will be able to propose a win-win solution or point you in the right direction.

FIND THE PERFECT

Investment House

To make a good investment, you need to work with a reliable agent who knows about rental properties and the special care that needs to be taken when buying or selling them. Give us a call and we can get started today. An agent can help you through the process and look out for your best interests as you look for and buy an investment property.

experience luxury living

Buying Your Dream Home

Our staff is dedicated to assisting you in finding the house of your dreams. We search for solutions that are within your price range and provide everything you need, providing you the opportunity to select the location of your base of operations without having to devote a significant amount of your own time to the process.

We strive to live up to the great expectations you have since we are fully aware of the luxury real estate industry. We collaborate with CPAs, attorneys, financial planners, and other experts who can assist us, comprehend, and get familiar with the populations our market serves.

sell your House

Make a Profit

Sell Your House for More

Our real estate professionals are well-versed in the intricacies of both the market and the process of putting a home up for sale. Our network of potential buyers is looking to purchase your house. We're proud of the fact that we know everything there is to know about the real estate market, from suburban homes to high-rise properties in Louisville, and everywhere in between.

Many people are relocating because they want to find a place to live that fits their lifestyle. Let our experts lead you through this process and get you SOLD.

Or talk to us about

Property Management

Our Property Management team is in charge of and runs a portfolio of properties, from remodeled old gems to the newest, best new buildings. Our team of experienced professionals works hard to make sure that both tenants and property owners get great service. We can help if you are looking for houses to rent in Louisville or if you need someone to take care of your property. Contact us right away, and our team will help you find what you need.

We do a great job of managing multifamily residential communities by using the best methods and the most up-to-date technology. We believe in giving our residents good service and taking care of our financial responsibilities to our owners and investors.

We Buy

ALL TYPES OF REAL ESTATE

- Residential

- Commercial

- Land

- Rental Homes

- Multi-Family Properties

- Mobile Homes

We Specialize in Selling

THESE TYPES OF REAL ESTATE

- Residential

- Commercial

- Land

- Rental Homes

- Multi-Family Properties

- Mobile Homes

- Businesses

Meet The Team